Deflation supercycle is over as world runs out of workers

Добави мнение Мнения:3

| http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/11882915/Deflation-supercyle-is-over-as-world-runs-out-of-workers.html The demographic 'sweet spot' is vanishing. We are on the cusp of a complete reversal, spelling the end of corporate hegemony By Ambrose Evans-Pritchard 9:46PM BST 23 Sep 2015 Workers of the world are about to get their revenge. Owners of capital will have to make do with a shrinking slice of the cake. The powerful social forces that have flooded the global economy with abundant labour for the past four decades years are reversing suddenly, spelling the end of the deflationary super-cycle and the era of zero interest rates. "We are at a sharp inflexion point," says Charles Goodhart, a professor at the London School of Economics and a former top official at the Bank of England. As cheap labour dries up and savings fall, real interest rates will climb from sub-zero levels back to their historic norm of 2.75pc to 3pc, or even higher. The implications are ominous for long-term US Treasuries, Gilts or Bunds. The whole structure of the global bond market is a based on false anthropology. Prof Goodhart says the coming era of labour scarcity will shift the balance of power from employers to workers, pushing up wages. It will roll back the corrosive inequality that has built up within countries across the globe. If he is right, events will soon discredit the sweeping neo-Marxist claims of Thomas Piketty, the best-selling French economist who vaulted to stardom last year. Mr Piketty's unlikely bestseller - Capital in the 21st Century - alleged that the return on capital outpaces the growth of the economy over time, leading ineluctably to greater concentrations of wealth in an unfettered market system. "Piketty was wrong," said Prof Goodhart. What in reality happened is that the twin effects of plummeting birth rates and longer life spans from 1970 onwards led to a demographic "sweet spot", a one-off episode that temporarily distorted labour economics. Prof Goodhart and Manoj Pradhan argue in a paper for Morgan Stanley that this was made even sweeter by the collapse of the Soviet Union and China's spectacular entry into the global trading system. The working age cohort was 685m in the developed world in 1990. China and eastern Europe added a further 820m, more than doubling the work pool of the globalised market in the blink of an eye. "It was the biggest 'positive labour shock' the world has ever seen. It is what led to 25 years of wage stagnation," said Prof Goodhart, speaking at a forum held by Lombard Street Research. We all know what happened. Multinationals seized on the world's reserve army of cheap leader. Those American companies that did not relocate plant to China itself were able play off Chinese wages against US workers at home, exploiting "labour arbitrage". US corporate profits after tax are now 10pc of GDP, twice their historic average and a post-war high. It was much the same story in Europe. Volkswagen openly threatened to shift production to Poland in 2004 unless German workers swallowed a wage freeze and longer hours, tantamount to a pay cut. IG Metall bowed bitterly to the inevitable. Cheap labour held down global costs and prices. China compounded the effect with a factory blitz - on subsidised credit - that pushed investment to a world record 48pc of GDP and flooded markets with cheap goods - first clothes, shoes and furniture, and then steel, ships, chemicals, mobiles and solar panels. Lulled by low consumer price inflation, central banks let rip with loose money - long before the Lehman crisis - leading to even lower real interest rates and asset bubbles. The rich got richer.  This era is now history. Wages in China are no longer cheap after rising at an average rate of 16pc for a decade. The yuan is overvalued. It has appreciated 22pc in trade-weighted terms since mid-2012, when Japan kicked off Asia's currency war. Panasonic is switching production of microwaves from China back to Japan. But the underlying causes of the deflationary era run deeper. The world fertility rate has steadily declined to 2.43 births per woman from 4.85 in 1970 , with a precipitous collapse over the past 20 years in east Asia. The latest estimates are: India (2.5), France (2.1), US (two), UK (1.9), Brazil (1.8), Russia and Canada (1.6), China (1.55), Spain (1.5) Germany, Italy, and Japan (1.4), Poland (1.3) Korea (1.25), and Singapore (0.8). As a rule of thumb, it takes 2.1 to keep the population on an even keel. The numbers of working-age rose sharply relative to children and - for a while - the elderly. The world dependency ratio dropped from 0.75 in 1970 to 0.5 last year. This was the sweet spot. "We are on the cusp of a complete reversal. Labour will be in increasingly short supply. Companies have been making pots of money but life isn't going to be so cosy for them anymore," said Prof Goodhart. The dependency ratio has already bottomed out in the rich countries. It now rising far more quickly than it fell as baby boomers retire and people live much longer. China will face a double hit, thanks to the legacy effects of the one-child policy. "They kept it going 15 years too long, disastrously," said Prof Goodhart. China's workforce is already shrinking by 3m a year. It is widely assumed that the demographic crunch will pull the world deeper into deflation, chiefly because that is what has happened to Japan - probably for unique reasons - since it pioneered mass dotage 20 years ago. The Goodhart paper makes the opposite case. Healthcare and ageing costs will drive fiscal expansion, while scarce labour will set off a bidding war for workers, all spiced by a state of latent social warfare between the generations. "We are going back to an inflationary world," he said. China will no longer flood the world with excess savings. The elderly will have to draw down on their reserves. Companies will have to invest again in labour-saving technology, putting their great stash of idle money to work. We will see a reversal of the forces that have pushed the world savings rate to a record 25pc of GDP and created a vast pool of capital spilling into asset booms everywhere, even as the global economy languishes in a trade depression. The "equilibrium rate" of real interest will return to normal and we can all stop talking about "secular stagnation". Central banks can stop fretting about the horrors of life at the "zero lower bound" (ZL The Bank of England's chief economist, Andrew Haldane, warned in a haunting speech last week that we may be stuck in a zero-interest trap for as far as the eye can see, with little left to fight the next downturn - typically requiring three to five percentage points of rate cuts to right the ship. "Central banks may find themselves bumping up against the ZLB constraint on a recurrent basis," he said. His answer is a menu of quantitative easing so exotic it trumps Corbynomics for heterodoxy. Professor Goodhart makes large assumptions. He doubts that robots will displace workers fast enough to offset the labour shortage, or that greying nations are culturally able to absorb enough immigrants to plug the jobs gap, or that India and Africa have the infrastructure to repeat the "China effect". The world has never faced an ageing epidemic before so we are in uncharted waters. What is clear is that the near vertical take-off of the dependency ratio is about to shatter all our economic assumptions. The last time Europe's serfs suddenly found themselves in huge demand was after the Black Death in the mid-14th century. They say it ended feudalism. http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/11882915/Deflation-supercyle-is-over-as-world-runs-out-of-workers.html |

| Истинското шоу още не е започнало. Засега се увеличава само средната продължителност на живота. Максималната не е мръднала от хилядолетия. Когато технологиите започнат да удължават максималната възраст, тогава ще започне истинското шоу. |

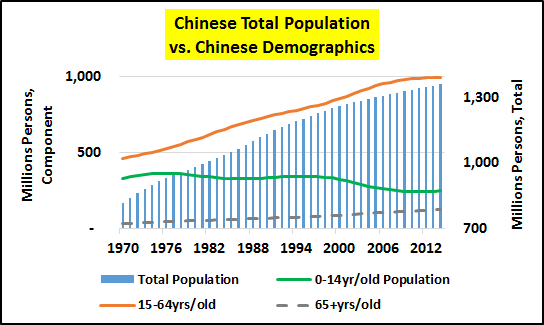

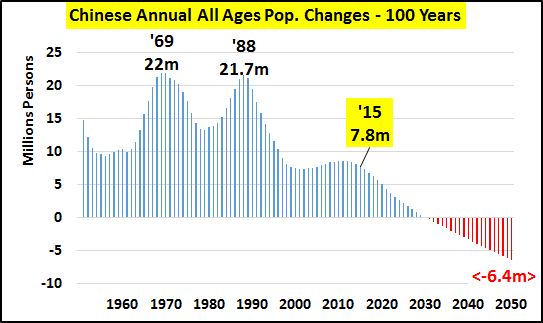

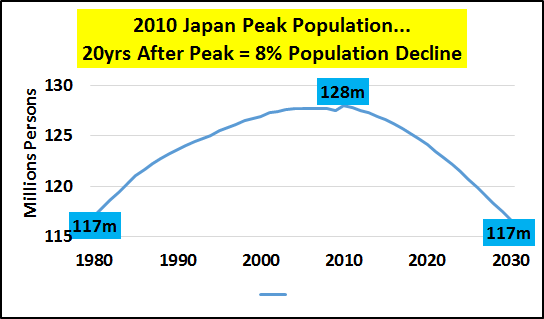

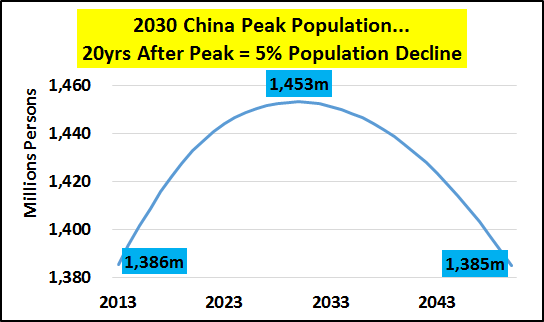

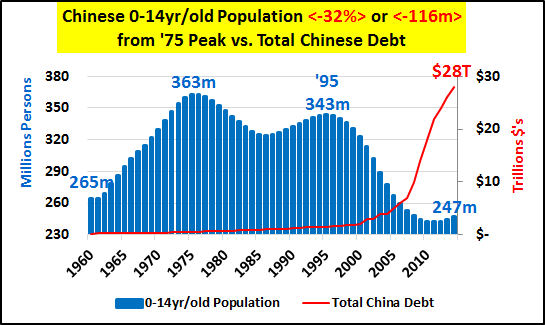

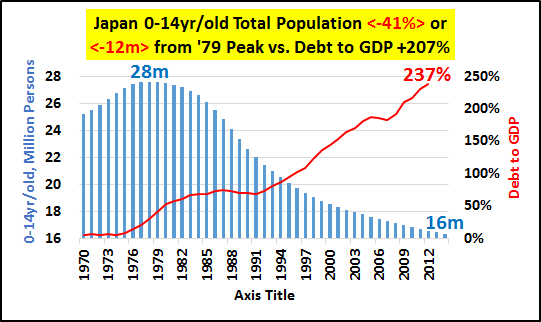

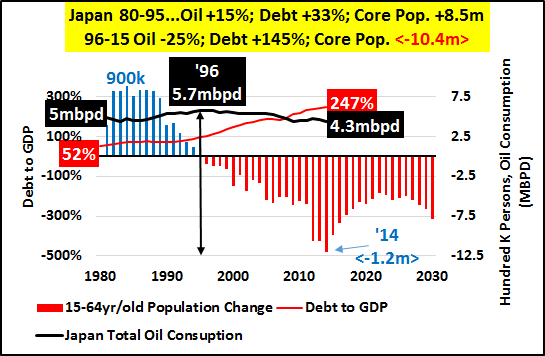

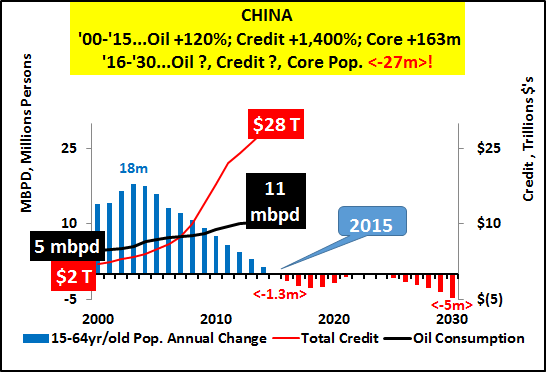

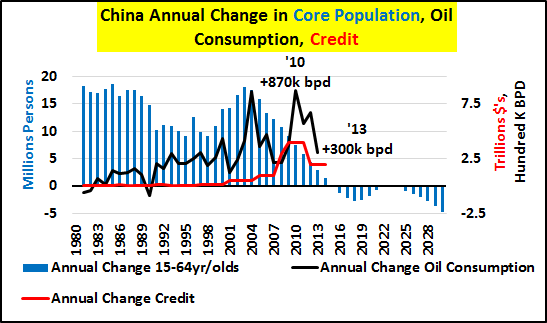

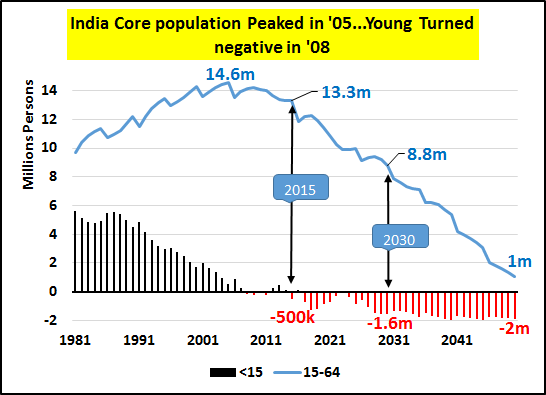

| http://seekingalpha.com/article/3526426-the-story-of-china-is-the-story-of-japan-just-10x-bigger Summary China core population (15-64yrs/old) turns negative in 2016 and total population peaks and begins receding in 2030. China's 1400% increase in credit from '00 to '14, primarily involved in funding real estate, has slowed to a crawl. Absent core population growth and/or significant ongoing credit growth, the China growth story and the global growth story (premised on China's 7% farcical growth) is just that, a story. I believe and will show why China's future growth (or lack thereof) should be seen in the same light as Japan's present and future. This article will outline 3 simple variables I don't see together much that are crucial to understand China's economic status. 1) China's demographics (particularly 15-64yr/old core), 2) China's credit/debt, and 3) China oil consumption (as a general proxy for economic activity). China's economic system, premised on core population growth that averaged nearly +15 million/yr for 35yrs, has seen the balance of those entering and exiting the core shift dramatically. The Chinese annual core population (15-64yr/old) growth peaked at +18 million/yr in 2003 and core population growth has been decelerating since. It is in response to this decelerating growth that China began perhaps the greatest credit/debt binge in human history to maintain economic activity. However, 2015 represents the last year (likely in our lifetimes) that Chinese core population will be positive, by a mere 250k. By 2016, China's core is estimated by OECD to shrink by <-1.3m> and continue to shrink at that general rate for the next decade. However, after that, the core shrinkage really picks up. By 2025 through 2044, the core shrinkage averages nearly <-6m> annually. This is not decelerating growth, this is not growth. This is outright decline. The question of what is to become of all the credit driven, Chinese excess housing (50-80 million excess, primarily higher end apartments), ghost cities, infrastructure build outs, etc. for a population that is never coming seems really appropriate about now?!? This is a nation with net emigration and long-term negative birth rates. How the Chinese government that encouraged this activity, that was bound to create the greatest real estate bubble and subsequent crash in history, plans to maintain power is a mystery. The scope of the upcoming Chinese RE crash is likely to make the previous Japanese and American crashes seem minor in comparison. Clearly, the negative impacts of China's adjustments will be felt far and wide. No growth to massive declines in consumption of commodities, consumer goods, etc. across the board will be the new secular norm. That analyst after analyst would suggest Chinese growth or stocks or consumption of much of anything would be positive and suggest China is a place to invest here and now... well, I just couldn't disagree more. Here's why... TOTAL POPULATION The first chart is that of a growing Chinese population (blue columns) most China bulls cite as evidence why China's future is like its bright past. However, a curious investor might take a glimpse at the lines representing the different demographic portions of that total population have been diverging for decades.  What I prefer to look at is the year-over-year change in population and demographics. The chart below shows China's annual population growth peaked in 1969 and nearly double peaked in 1988 at an annual net increase of 22 million Chinese. Since those heady days of simply amazing growth, things have changed a tad. By 2015, Chinese population growth has decelerated to 7.8m/yr or about a 65% decline from peak growth.  But 2015 is just the start of China's transition to "Japan-West." A quick look at Japan and China's population peaks and estimated declines (charts below) shows how similar the tracks are, China 2 decades behind Japan.   THE YOUNG And how did China's population decline take root? Go to the headwaters and follow the changes in the young population (below). This is a 30%+ decline which is making its way into the core population and this is unavoidable. Even any unlikely increases in the birthrates now would be decades away from boosting the core population.  And Japanese declining young population (below) for comparison. The 41% decline working its way into the core population is stunning and likewise unavoidable.  THE CORE I'm going to focus on 15-64yr/old core population changes vs. debt and oil consumption. This segment seems to be the key driver of national economic activity. The Japanese peak core population was 1996, the same year Japanese oil consumption peaked (this is the same in Germany and generally true in most advanced nations). Both core population and oil consumption have continued to decline since '96 despite total population growth which only peaked in 2010. Interest rate cuts, debt, and deficits have been unsuccessfully substituted for declining demand... demand set to decline still for decades.  One look at China (below) and it should be clear that absent Chinese population growth and/or significant credit growth - Chinese oil consumption and general economic activity is very likely set to fall. And fall for decades just like Japan!!!  I've tried to make the linkage of peak core populations, peak oil consumption, and the substitution of credit/debt to maintain consumption previously. It can be read hereНатисни тук. Lastly, the chart below highlights the annual increases in Chinese oil consumption vs. annual increases in credit and core population. There are two distinct annual consumption spikes in '04 and '10. The '04 spike with the introduction of greater credit to still significant core population growth. The '10 spike in oil consumption was record credit and rapidly decelerating core growth.  CONCLUSION The upcoming changes in core population are a given and the credit engine of the Chinese housing bubble has gone bust... I have a hard time understanding where analysts could offer the buy China mantra I see so often other than the moral hazard approach. The real question should be how bad will it get and for how long? It also takes real effort to miss Japan and China's parallels utilizing currency arbitrage for export driven booms coincident with slowing birth rates and declining population growth. All this during rapid periods of industrialization. Both nations attempted to avoid the slowing organic growth by credit fueled real estate and equity bubbles that inevitably popped. Both bubbles will be followed by deflationary, demographic driven depressions. The BOJ and PBOC will make every ill-fated attempt to boost growth and asset prices, ultimately all to no avail. Only central bankers would think to attempt resolving imbalances by doubling or quadrupling the imbalance. EXTRA CREDIT One peek at India's demographics and you should know where this story is going.  http://seekingalpha.com/article/3526426-the-story-of-china-is-the-story-of-japan-just-10x-bigger |

Добави мнение Мнения:3